It was a busy Thursday morning, and the office hummed with activity. John and Jan, two senior immigration attorneys, were reviewing recent USCIS notices over coffee. Piles of files and laptops surrounded them, but one email caught their attention-an EB-5 project compliance audit had been scheduled.

A Conversation Between Two Top Attorneys: John and Jan

John:

“Jan, USCIS just notified us about a compliance audit for our EB-5 project. These audits are so detailed-it feels like they look at every single document.”

Jan:

“I know, John. But our paralegals make these audits so much easier. They can pull together investor documents, financial statements, and job creation reports in no time.”

John:

“That’s impressive, but how do they handle all of it without missing anything?”

Jan:

“They start by organizing all audit documentation, ensure clear evidence of investment compliance and job creation, and then coordinate attorney responses efficiently. I’ll show you how it works in practice.”

The Role of Paralegals in EB-5 Compliance Audits

1. Swift Assembly of Audit Documentation

Paralegals begin by collecting and organizing all necessary documents, including:

-

Investor subscription agreements

-

Escrow statements

-

Corporate records

-

Tax filings

Example:

For a project with 30 investors, a paralegal utilized a centralized digital system to store all documents, ensuring quick access during the audit.

2. Ensuring Clear Evidence of Investment Compliance and Job Creation

They verify that funds were lawfully obtained and properly invested, and that job creation numbers are accurate, showing both direct and indirect employment.

Example:

In a recent project, a paralegal coordinated with accountants to create a detailed job creation spreadsheet, linking each investor to specific positions generated by the project.

3. Efficient Coordination of Attorney Responses

Paralegals track USCIS questions, prepare draft responses, and submit them promptly, reducing delays and ensuring accuracy.

Example:

During an audit, USCIS requested clarification on an investor’s source of funds. The paralegal quickly gathered the necessary documentation and submitted it on time, avoiding unnecessary follow-ups.

4. Utilizing Technology for Enhanced Efficiency

Paralegals often use digital tools to enhance efficiency:

-

Digital document management for instant access

-

Checklists and templates for recurring audits

-

Project management tools to track USCIS questions and deadlines

These practices save time, reduce errors, and ensure audits proceed smoothly.

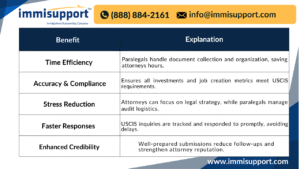

Benefits of EB-5 Compliance Audit Paralegal Services for Attorneys

Why ImmiSupport is the Best Choice for Attorneys?

At ImmiSupport, we specialize in EB-5 compliance audit paralegal services tailored for attorneys. Here’s why we stand out:

-

Expertise in EB-5 Regulations: Our team understands the nuances of USCIS requirements.

-

Time-Saving Solutions: We handle documentation, allowing attorneys to focus on legal strategy.

-

Accurate & Organized Data: Centralized, audit-ready records reduce risk of errors.

-

Seamless Communication: We coordinate with attorneys to prepare responses efficiently.

-

Proven Track Record: Numerous regional centers and attorneys trust us for smooth audit management.

What Did We Learn?

-

Paralegals are essential for smooth EB-5 compliance audits.

-

Accurate documentation and verified compliance reduce audit stress.

-

Technology and organization improve efficiency and accuracy.

-

Attorneys save time and can focus on legal strategy.

-

ImmiSupport is a reliable partner offering expert EB-5 audit support.

What People Are Asking?

1. What are EB-5 compliance audit paralegal services?

They involve paralegals gathering, organizing, and verifying all EB-5 documentation, and coordinating attorney responses for USCIS audits.

2. How do these services benefit attorneys?

They save time, ensure accuracy, reduce stress, and allow attorneys to focus on legal strategy.

3. Why choose ImmiSupport for EB-5 audits?

ImmiSupport offers expert paralegal services with a proven track record in handling complex EB-5 compliance audits efficiently.

4. Can paralegals manage both documentation and USCIS inquiries?

Yes, they collect all necessary documents, verify compliance, and prepare draft responses for attorney review.

5. How do EB-5 paralegal services improve audit outcomes?

By providing organized, accurate, and timely submissions, paralegals reduce errors, follow-ups, and delays, strengthening attorney credibility.

Disclaimer:

For informational purposes only; not applicable to specific situations.

For tailored support and professional services,

please contact Immisupport, at +1 888 884 2161

Email: info@immisupport.com

Book a Demo: https://immisupport.com/demo/

Rated 4.9/5 by immigration attorneys. If you are looking for Outsourcing services for your Immigration practice, please email 📧info@immisupport.com or call 📞(888) 884-2161.

Book a demo to build your team today

Book a demo to build your team today

let’s talk - meet with Immigration Outsourcing expert

let’s talk - meet with Immigration Outsourcing expert