It was mid-morning, and John and Jan, two senior immigration attorneys, were reviewing an EB-5 investor case. The investor had multiple sources of funds, including a business sale, foreign investments, and personal savings. Piles of bank statements, contracts, and wire transfer receipts were spread across the desk.

A Conversation Between Two Top Attorneys: John and Jan

John:

“Jan, this EB-5 investor’s financial history is intricate. Multiple income streams, international transactions-it’s a lot to manage. If we don’t present this correctly, USCIS might issue an RFE.”

Jan:

“That’s where our immigration paralegals come in. They specialize in organizing complex financial data, ensuring that every source of funds is documented clearly and complies with USCIS requirements.”

John:

“Can they handle such detailed documentation?”

Jan:

“Absolutely. They meticulously trace each dollar, from its origin to the EB-5 investment, ensuring a transparent and lawful path.”

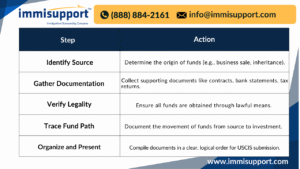

Key Steps in EB-5 Source of Funds Documentation

To provide a clear overview, here’s a table summarizing the essential steps involved:

Best Practices for Attorneys

-

Maintain Clear Records: Ensure all financial documents are up-to-date and accurately reflect the source of funds.

-

Avoid Commingling: Keep EB-5 investment funds separate from other personal or business funds to simplify tracing.

-

Certified Translations: For non-English documents, provide certified translations to meet USCIS requirements.

-

Detailed Narratives: Include clear explanations for complex financial histories to aid USCIS understanding.

What Did We Learn?

-

Thorough Documentation: Detailed and organized records are crucial for demonstrating the lawful source of funds.

-

Role of Paralegals: Skilled immigration paralegals play a vital role in ensuring compliance and reducing the risk of RFEs.

-

Attorney Oversight: While paralegals handle documentation, attorneys must oversee the process to ensure legal integrity.

What People Are Asking?

1. What are the most common sources of EB-5 investment funds?

Common sources include personal savings, business earnings, property sales, gifts, and inheritances.

2. How far back should we document the source of funds?

USCIS may require documentation going back several years, depending on the complexity of the financial history.

3. What happens if we can’t trace the source of funds?

Failure to trace funds can result in RFEs or denial of the EB-5 petition.

4. Can we use funds from a loan?

Yes, but the loan must be secured by the investor’s personal assets, and the source of the loan funds must be documented.

5. How can ImmiSupport assist in this process?

ImmiSupport provides experienced immigration paralegals who specialize in EB-5 documentation, ensuring compliance and thoroughness.

Disclaimer:

For informational purposes only; not applicable to specific situations.

For tailored support and professional services,

please contact Immisupport, at +1 888 884 2161

Email: info@immisupport.com

Book a Demo: https://immisupport.com/demo/

Rated 4.9/5 by immigration attorneys. If you are looking for Outsourcing services for your Immigration practice, please email 📧info@immisupport.com or call 📞(888) 884-2161.

Book a demo to build your team today

Book a demo to build your team today

let’s talk - meet with Immigration Outsourcing expert

let’s talk - meet with Immigration Outsourcing expert